Introducing Current Account from Your Credit Union

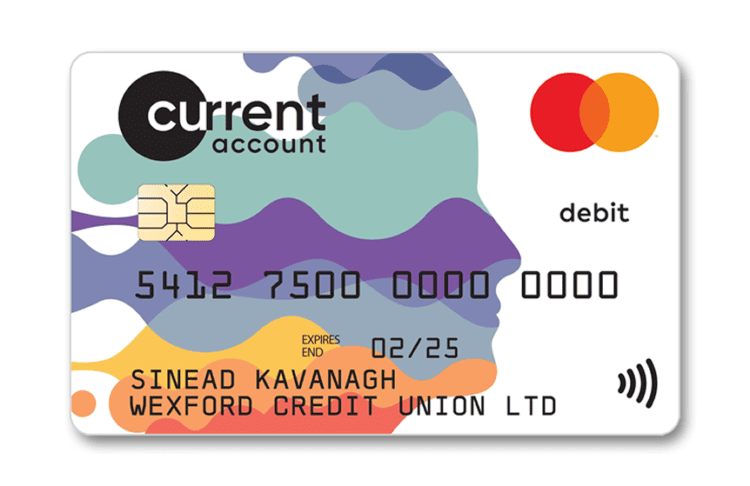

With instant access to your money through a Mastercard® Debit Card, a secure app and online portal and mobile functionality, you can pay your bills, withdraw cash and pay at point of sale; anywhere in the world.

You can now manage your daily finances no matter where you are in the world. With access to your funds in-branch, online or on the web app, Current Account from your credit union gives you all the benefits you expect, but with the personal touch of your trusted credit union.

Features & Benefits

- Easy to sign up

- Same friendly service

- Globally accepted Mastercard® Debit Card

- Use in-store, online or at ATMs

- Cashback available at participating retailers

- Contactless payment

- Transparent Fees

- No surcharge interest on overdrafts

- Automate regular payments using Standing Orders & Direct Debits

- Stay in control with our Mobile web App, eStatements and eFee Advices

- Secure online shopping

- 24/7 support for lost/stolen debit cards

The safer, contactless way to pay

You can now use your Apple device to pay with your Credit Union Debit MasterCard© wherever you see the Apple PayTM or contactless logo in store, online or in-app.

Say hello to Google Pay and and Google Wallet

You can now use Google PayTM and Google WalletTM to make contactless payments wherever you see the contactless payment mark. Available now with your Current Account debit card from your Credit Union!

How to Apply

If you are a member of Wexford CU with a CU Online Account – you can apply via the Wexford Credit Union app or your CU Online Account.

If you are a member of Wexford CU but do not have CU Online Account – you can register for CU Online or you can apply in any of our offices.

If you are not a member, you can become a member and open an account in any office, our opening hours are listed here.

Find out more

Find out more at currentaccount.ie

All you need to know about Current Account is available here https://currentaccount.ie/

Terms & Conditions

You can read a full copy of the Terms & Conditions here.

Fees & Charges

As you would expect from your credit union, Current Account has simple and transparent pricing. A low monthly fee of €4.00 applies and that covers unlimited Euro point of sale and contactless transactions, unlimited mobile and online banking and unlimited standing orders and direct debit processing and up to five Euro ATM withdrawals per month. Full details of fees and charges are available here.

Currency Conversion

Currency Conversion Calculator

When you use your Debit Card for purchases in foreign currency or ATM withdrawals in foreign currency, these transaction will attract additional fees and charges that are charged to your Current Account as they occur, typically on the date the transaction is posted to your Current Account.

Mastercard foreign exchange rates will also apply and are subject to change.

This currency conversion calculator allows you to see the foreign exchange rates set by Mastercard to convert from the transaction currency as well as the European Central Bank's euro foreign exchange reference rates for the EEA country currencies and the fees and charges that apply.

Check out our Currency Conversion Calculator.

Card Safety Guidelines

With Card payments being one of the safest and most convenient ways to pay for goods and services many stores do not even touch your card and get you to enter it in to the payment terminal yourself since the introduction of Chip & PIN. There are always situations where this is not the case and it is important that at a minimum you always keep the card within your sight.

Your Debit Card details can be used fraudulently even when the card itself is safely in your care, so it is vital to check your statements regularly. If you identify purchases that you didn’t make, you must report them immediately to your Credit Union or Credit Union Card Services team on +353 (1) 693 3333 available 24/7.

Your Debit Card details can be used fraudulently even when the card itself is safely in your care, so it is vital to check your current account statements regularly. Click here for a list of handy guidelines.

Current Account FAQs

What is a current account?

Current Account, from your trusted credit union is a full service account that allows you to access a range of facilities, such as receiving your salary, paying bills setting up direct debits and standing orders to make regular payments. You can operate your account online and using the mobile app.

With Current Account, from your credit union, you get a dedicated IBAN (International Bank Account Number). You also get a Mastercard Debit Card with Contactless payments which allows you instant access to your money so you can make a payment or withdraw money whenever or wherever you need.

Who can apply for a Current Account?

If you are a member of a participating credit union and are aged 16 years or older then you can apply for a Current Account and Debit Card.

If you are a member of a participating credit union and a registered online banking user you can apply directly through online banking for your Current Account and Debit Card.

How do I open a Current Account?

If you are registered online with your credit union, you can open a Current Account in your sole name online. Simply log in here to open your Current Account.

If you are not registered online or wish to open a joint account, you will both need to drop into your credit union office.

What documentation do I need to open a Current Account?

To open your Current Account either online or in your credit union office, you will require one proof of identity and one proof of address.

Acceptable Proof of Identity:

- Current valid signed passport/passport card

- Driving Licence – Full licence or learners permit

Acceptable Proof of Address*:

- Bank, building society or credit card statement (paper/e-format)

- Household utility bill (paper/ e format)

- Revenue Commissioners current balancing statement or Notification of Determination of Tax Credit/Tax Notification

*Note: These documents must have been issued in the previous six months

Can I open a joint account?

A joint account can be opened but not online. Both parties to the account must call into your credit union office with their proof of identity and proof of address to sign the application form.

How do I start using my account?

Once your Current Account is opened you will receive a welcome letter from your credit union detailing your BIC and IBAN. You will need your IBAN to arrange to have your salary, benefits or other payments paid into your account and to set up payment of bills by direct debit etc.

If you are registered for online access your Current Account is immediately available to view and use online or on the mobile app. If you are not already registered for online access, you can register online or visit your local credit union.

How will I get my statements?

You will automatically receive an eStatement for free on your Current Account every quarter, in April, July, October and January. If you have opted to receive quarterly paper statements, a charge of €2.50 will apply.

You also have the option to request a paper statement for a fee of €2.50 per statement.

Can I have an overdraft on my account?

You can apply for an overdraft on your Current Account from €200.00 up to a maximum of €5,000.00.

- The interest rate is 12% pa variable. Interest is only charged on overdrawn balances. Your credit union does not currently apply surcharge interest (surcharge interest is charged by some Financial Institutions on unauthorised overdrawn balances.

- An overdraft fee of €25.00 is charged on approval and on each anniversary of the overdraft approval date.

- We will normally request you to provide payslips, bank statements, credit card statements and proof of rent payments (if applicable) for the last three months in support of your overdraft application.

- Overdrafts are subject to financial status and are not available to persons under 18 years of age.

Terms and conditions apply

Credit facilities are subject to repayment capacity and financial status and are not available to persons under 18 years of age. Security may be required. An overdraft facility fee of €25 per annum or per overdraft sanction, whichever is the more frequent will be applied.

You can apply for an overdraft in your CU Online Banking or 'Wexford Credit Union' app, over the phone on 053 912 3909 or in person in any office.

Can I switch my Current Account to Wexford Credit Union?

Yes you can transfer your account to Wexford Credit Union, check out the Current Account Transfer Guide.

Debit Card FAQs

How many debit cards can I have on my current account?

For each sole account you open will have one card. For a joint account each account holder can have one card in their own name.

How many PIN tries do I have when using my card at an ATM or to make a purchase?

If you accidentally block your PIN at a point of sale terminal, you can simply go to an ATM and unblock your PIN.

If you accidentally block your PIN at an ATM please contact our Current Account Card Services Team on +353 (1) 6933333

What do I do if my card is lost or stolen?

Notify your Credit Union or call +353 (1) 6933333 immediately. We will then cancel your card immediately and a new card and PIN will be issued to you at your request.

How can I request a refund on my Debit Card?

Members will have 120 days to dispute a transaction on their Debit Card for the following reasons:

- Duplicated transaction

- Goods not received

- Cancelled subscription not actioned

- Received goods not as described

- Refund not processed after 30 days

- Transaction not recognised

- Free Trials

- Car Rentals

If you have identified a transaction that you are suspicious of on your Debit Card, you must contact your Credit Union or Credit Union Card Services team immediately on +353 (1) 6933333.

In the first instance, you should contact the Retailer and request a refund. If the Retailer refuses to refund your money and you paid using your debit card, you should contact your Credit Union who may initiate a dispute with the Retailer to reverse the transaction. This is called a “Chargeback”.

Members must complete and return a ‘Disputed Transaction’ form along with copies of any:

- Detailed cover letter advising the nature of the dispute

- Proof of purchase

- Evidence of the transaction

- Interactions with the company (emails/letters)

To be returned to their Credit Union to complete a ‘chargeback’ request.

What happens if my debit card is damaged?

You can order a replacement card by calling Credit Union Card Services on +353 (1) 6933333 (Our Customer Services line is open 24 hours a day, 7 days a week. Calls are charged at your standard network rate. Calls from mobiles may be higher).

We will order you a replacement card which will be issued within 7-10 working days.

How do I receive my PIN for my Debit Card?

You can receive your PIN by SMS by following the instructions on your Debit card mailer or by calling Credit Union Card Services on +353 (1) 6933333.

You can receive your PIN through the Post by calling Credit Union Card Services on +353 (1) 6933333 or contacting your local Credit Union.

(Our Customer Services line is open 24 hours a day, 7 days a week. Calls are charged at your standard network rate. Calls from mobiles may be higher).

Can I change my card PIN?

Yes. You can change your card PIN to something more memorable at most ATM machines. You just need to have your card available, enter your existing card PIN and follow the instructions.

Can I get cash using my card?

Yes. You can obtain cashback up to €100.00 when making purchases at participating retailers.

You can also withdraw up to a maximum of €700.00 per day at ATMs located through the country and abroad. (Withdrawal limits at ATMs vary).

Can I use my card abroad?

You can use your card anywhere in the world where the Mastercard Acceptance Mark is displayed. Foreign exchange fees and charges apply where the transaction is performed outside the Eurozone.

Can I use my card for shopping online?

Yes. You can shop at participating websites using your card. Mastercard SecureCode is a free service that provides cardholders with additional security and peace of mind when shopping online. During the checkout process when shopping online, you may be asked to register for the Mastercard SecureCode service.

Important Information

To apply for a Current Account and Debit Card you are required to be a member of your credit union and be aged 16 years or older. Terms and conditions apply.

Overdrafts may be available to Current Account holders who are aged 18 years or older. Lending criteria and terms and conditions apply.

Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated. This card is issued by Transact Payments Malta Limited pursuant to licence by Mastercard International. Transact Payments Malta Limited is duly authorised and regulated by the Malta Financial Services Authority as a Financial Institution under the Financial Institution Act 1994. Registration number C 91879.

Google, Fitbit, Android and Google Pay are trademarks of Google LLC.

Apple, the Apple logo, Apple Pay, Apple Watch, Mac, MacBook Pro, Face ID, iPad, iPhone and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries.